Tax Table 2017 Malaysia

On the first 5 000 next 15 000.

Tax table 2017 malaysia. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Fortnightly tax deduction tables monthly tax deduction tables annual tax deduction tables. This page is also available in. Calculations rm rate tax rm 0 5 000.

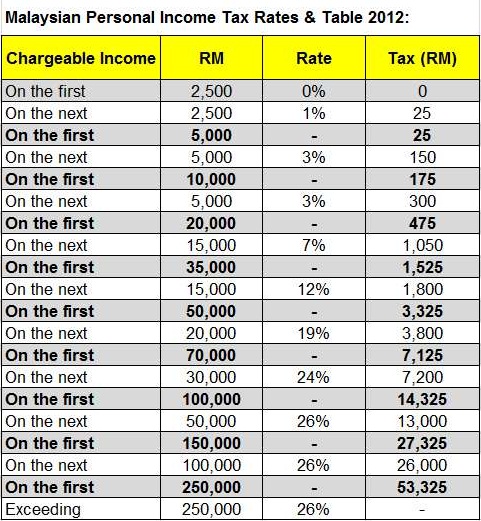

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. On the first 2 500. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to.

Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. Malaysia has no wht on dividends in addition to tax on the profits out of which the dividends are declared. 2016 1 march 2015 29 february 2016. Interest on loans given to or guaranteed by the malaysian government is exempt from tax.

Some items in bold for the above table deserve special mention. Total deposit in year 2017 minus total withdrawal in year 2017 6 000 limited. Income attributable to a labuan. No guide to income tax will be complete without a list of tax reliefs.

Some treaties provide for a maximum wht on dividends should malaysia impose such a wht in the future. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Green technology educational services. Other employment tax deduction tables.

Annual tax deduction tables. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25. Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Receiving further education in malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses.

17 1 2017 income under paragraphs 4a i and 4a ii of the ita which is derived from malaysia is chargeable to tax in malaysia regardless of whether the services are performed in or outside malaysia.